AdviserTech LIVE 10 - The Power of Straight Through Processing

We had a great turn out to our

AdviserTech LIVE 10

online webinar event, where industry platform giants demonstrated how to leverage the power of straight through processing using moneyinfo.

We were joined by platform experts

Seccl

,

SEI

, and

Transact

, who demonstrated how they are collaborating with moneyinfo to drive tangible and measurable time and cost savings for every stakeholder in your business.

Whether you run a small financial planning practice, or regional / large scale wealth management business, watch AdviserTech LIVE 10 to discover how best of breed solutions suit all operating models.

More information on each session

|

Annabel Melvin, Head of Launch Showcasing the seamless drawdown and instant deposit features of a Seccl powered platform |

|

Sophie-Anne Cowper, Solutions Consultant Powering the future of wealth - Operating at Scale |

|

Richard Green, Business Development Manager & Tom Dupuy, Project Team Manager Transact Exploring how Transact’s marketing-leading breadth makes financial planning easier |

|

Tessa Lee, Managing Director Creating a new advice ecosystem: Digital relationship management going beyond valuation reporting |

Want to take it one step further?

Book a personal demonstration to find out how straight through processing delivers improved profitability, increased client loyalty and compliance confidence for your firm.

Welcome to Advisor Tech Live 10 - From platform to clients - The power of straight through processing.

For those of you that don't know too much about us, we deliver branded apps for financial advisers, wealth managers and your clients that allow you to digitally re-engineer your business eliminating paper and securing your communications. From tracking total net-worth to secure messaging and document sharing, we automate your everyday processes like onboarding and client reviews giving you back time to spend with your clients whilst reinforcing your brand and increasing your value.

I'll be your host, guiding you through the brilliant sessions where you'll discover how forward-thinking technology firms are working really hard together to deliver true straight through processing that can change the way we all do business for the better. I'd like to say a big welcome and a thank you to our friends at Transact, Seccl and SEI for taking part in today's webinar. These platforms are really driving true time and cost savings for you and this session is about showcasing how they can support businesses like yours to deliver a better way to do business.

Today's technology can integrate better than ever before and with the enhancement of data feeds with richer data sets and more extensive APIs [1] we are increasingly seeing firms taking a best of breed approach to their technology, building an ecosystem that's to give them control over their business processes and their client and advisor experiences.

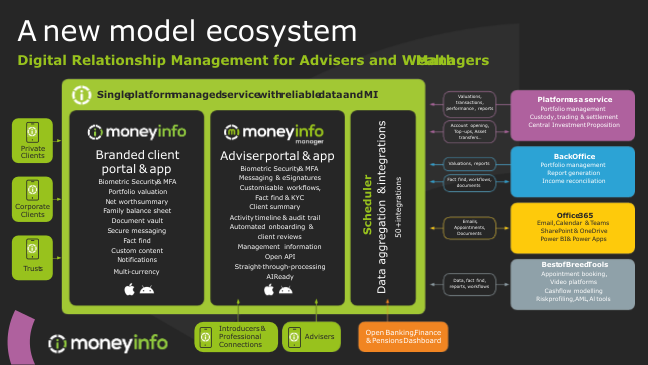

This new model ecosystem is driving efficiency, delivering a better client experience and providing compliance confidence through clean and accurate data for every part of the business. Moneyinfo is the heart of the ecosystem, a digital service channel to complement your existing technologies from your back office to your platforms, together with your Microsoft apps and other tools you may be using such as risk profiling and cashflow modelling.

Today we're focusing on how moneyinfo and our platform partners are connecting this ecosystem together to deliver straight through processing.

Our workflow-based framework supports deep integration of platform processes such as account opening and tightly embeds them through secure messaging removing friction and keeping both you and your client informed of where they are in the process.

To reinforce how important it is that your clients can access your Services via an app we have just over 180 firms running moneyinfo with 130,000 clients. In March this year, we had 260,000 logins of which 190,000+ were via the app. That's more than four times as many per app user as web-based desktop access.

(4.10) Workflow Demonstration

The demonstration shown through the smartphone app shows a typical onboarding process with video introduction, document approval for the client agreement, meeting booking, in case of emergency document vault and the customisable and collaborative know your client fact find process. It ends with the recommendations delivered and the data passed through to the platform to automate the account opening process. Once opened the platform is added to the moneyinfo database with the provider IDs which allow it to be updated through our daily bulk data download integrations. There is zero re-keying of any data and a full compliance audit trail.

It’s an example of how a straight through onboarding process can work from initial client engagement to account opening removing friction and keeping you and your client informed - all driven through your own branded app.

(13.15) Transact Presentation

it's time now to hand over to the first of our guest presenters and first up we've got Richard Green, business development manager and Tom Dupuy, Project Team Manager from Transact who will be demonstrating how they make financial planning easier and their plans to support a more integrated advisor ecosystem.

Transact is built on proprietary software which means we are more responsive have more control over the development and quality of our code and carry out more frequent releases than our competitors. It also means we can move quickly if a new chance to innovate appears and that's how we see the opportunity to work with moneyinfo.

We have a monthly platform release cycle and the latest release is number 467 since the transact platform was launched 24 years ago. Think of it as like the apps on your smartphone silently updating in the background each month to deliver the latest improvements and changes so users receive a succession of iterative versions every four weeks or so. There's no sudden surprises and crucially no need for re-platforming as transact has the widest range of portfolio types which include corporate portfolios, trustee portfolios plus third parties such as SIPP and SASS trustees and several offshore bond providers. Our general investment account provides flexible family linking rules so you can link portfolio types to a single-family group including children and grandchildren to offer multi-generational financial planning

We continue to refine our guided application process with the objective of minimising and eventually removing the need for paper and we're shortly introducing within the application process online confirmation of whether the ID and Bank verification has passed or failed. Because of the broad range of assets and wrappers available we need to ensure new developments work across as much of our asset range as possible.

Transact is an open architecture platform which means we can provide advisers and their clients access to alternative asset types such as shares ETFs, Investment Trusts, VCTs, Structured Products, Term deposits and even Gilts. Following our latest release users are able to transfer both assets and cash between wrappers and portfolios within the same family group. As an example, Mr. Miggins could move the funds from his GIA directly to his wife's GIA as an interspousal transfer with a few simple clicks.

We take an agnostic approach to adviser Central Investment Propositions and have functionality to support both an advised or discretionary managed proposition. Discretionary managers can be appointed online individually or in bulk.

(19:05) Future integration strategy

As a bit of history, we've spent most of the time over the past 20 years developing tools for our website but more recently our time is working on our digitalization project. We've had valuation data available via an API for over 20 years and have recently made strategic acquisitions so that we can operate more in this space, we acquired Time 4 Advice which has the back office Curo System and also Sprint which offers client reporting solutions including performance.

We've had a good understanding from operating with these two other firms how a platform and back office can work together and see integration as a future critical part of the advice process. We see this freeway ecosystem between the platform, the back office and the portal with the portal coming to the fore in the last few years.

Integration wise, we've had valuation data live for a long time and we've now got a feed for transactional data. We’re adding fee reconciliations in the coming months and will be running a pilot with moneyinfo for the consent process enabling the client to sign up to the transact portfolio within the moneyinfo app. It's important that we remove as much friction from these processes as possible and by putting the consent into the portal that happens a lot earlier on giving the adviser a lot more freedom and it’s a lot less hassle for the client.

(22.30) Automated Reporting

We've got an obligation to share documents with clients and we don't want people to have the hassle of having to go in and log into our website to view them so they will be able to use the document vault in the moneyinfo app to access the documents that we need to get to the client.

This uses moneyinfo’s automated reporting functionality – see link here , which automates the delivery of documentation down to the client from the platform including quarterly statements and contract notes. Any documents that you would get from the document pickup area we can now deliver directly down to the client through the moneyinfo app. The client gets a push notification to say that a documents been received, it's audited and tracked through their document Vault and the firm gets the read history stats so they can see that which documents have been opened by their clients.

It’s a huge time saving for advice firms and important that the three key pieces of technology in an advice firm can connect together successfully - the platform, the back office and the portal and we're working with you and with our friends at the back offices and CRMs to bring those things together. Processes are shifting because the client is now digitally involved so it's really exciting.

“We've had a lot of demand over the last 10 years for a Transact app and then that's fallen off the face of a cliff with the introduction of the adviser portal because if you're advising on multiple things that aren't all on the Transact platform, your client would not want to go to several different apps or websites. You've got a one-stop shop with your client portal where you can see it all under one roof.”

Longer term we see the sky being the limit. We're looking at other ideas around data sharing and investment instructions and want to look and see where the market takes us and see what the demand is so we're open to enabling anything that people want and going with the demand. If you’d like to know more please get in touch to talk about anything that we've spoken about. Contact information for all speakers is available at the end of this newsletter.

(27.50) Q & A for Transact

What are your plans to develop and invest in the Curo platform and back-office system?

There's a lot of API stuff that we're looking at now we've got them in-house. A lot of our ideas integrating with back-offices we bounce over them and we're doing good work with Curo and T4A being a strategic platform partner for them. We're integrated quite closely with them for both data and for communications going back into that back office and there's more to come.

“The message from all of us is we're all now talking together. Our friends in the technology sphere are getting together and really driving integrations to help your businesses work more easily and engage better with your clients.”

Is transact going to be sending EDI information to Intelliflo for fees?

We've had to do a bit of extra build for that and it's one of the things that we're hoping to have live in the in the coming months. It's on the road map.

(29.00) Are you using AI to improve or update your processes?

Smatterings I would say. It's a key theme and AI has the power to transform us. If we thought we'd done a lot with digital transformation over the last 10 years wait till we see what happens with AI. We're seeing some simple use cases that we can implement that will make a big difference to advice firms that we're working with including meeting transcriptions but more on that another time.

(30:12) Seccl Presentation

Annabelle Melvin, head of launch, at Seccl showcases the client onboarding and instant deposits features of their platform.

Our fully digital investor onboarding flow allows clients to sign up and accept platform terms within a matter of minutes and our instant deposit functionality allows clients to put their money to work immediately. And a very quick glimpse of our newly launched professional user interfaces.

Seccl’s platform is the embedded investment platform to help forward-thinking firms build the investment propositions of the future. Providing custody trading and portfolio management functionality all through our single API. Our platform is genuinely API first, inherently flexible and free from legacy and this has helped us to create new standards of speed, efficiency and excellence. The investor signup flow and instant deposit are really great examples of this.

(31:47) Digital onboarding journey

When a client signs up to a new adviser platform there are various terms and declarations that they need to view and accept to start transacting and in some cases these might require a wet signature. The sign-up process can appear seamless but there may be additional documents that need to be submitted afterwards to complete it and it's a real point of friction when a client just wants to get onboard and start transacting on their new platform. As well as this, with manual processes there's always room for error or missing information that can add even more time. We can streamline this through our fully digital and entirely paperless onboarding journey.

All functionality can be seamlessly embedded into another application and we are continually reiterating our product and functionality that we offer. We did over a thousand releases last year.

(36:19) Integrated digital onboarding with moneyinfo

“We announced the integration with moneyinfo a few months ago, which has just been released into pilot. It allows the Seccl powered platform to gather client acceptance of suitability as well as platform and wrapper terms all in one go through the moneyinfo client portal and as soon as the acceptance is received the Seccl system is automatically updated and transactions can begin. This new integration further enhances the digital and paperless approach to onboarding and could potentially save weeks of back and forth and delay creating a more efficient, more streamlined and more engaging onboarding flow for clients and advisers alike.”

(37.26) Instant Deposits

A live demo of a client making a payment by bank transfer to their advisor platform. Historically, the cash is handled by the platform's operations team and the client and adviser could wait anything from a few hours to a few days before the money is reconciled and allocated to the right account and again this is a real point of friction in the investment journey. It feels incredibly outdated and incongruous to what users should expect.

When a client sends money by bank transfer to their Seccl powered platform the money will be visible in their platform account straight away. It is worth noting that this will only work when the adviser creates a payment expectation and the client sends the right amount with the correct payment details otherwise the money will land into something that we call unidentified receipts and we still need to share that information with the platform ops team so they can view and confirm where we should allocate it.

This functionality allows us to provide a market-leading level of operational efficiency to the platforms that we power. Seccl has just three people in our cash team and we serve over 160,000 end clients and ultimately this efficiency drives cost savings for clients delivering a better faster and more affordable service.

(41.04) Q&A for Seccl

What are the three USPS of the Seccl platform?

- We are API first and I think lots of providers bandy this term around but what this means is that you have complete flexibility over designing your client journey to fit your client base. I think what we're doing with moneyinfo is a really good example of how you can plug into Seccl really easily and quickly.

- We have a single code base so any functionality that we're deploying is immediately available to all our platforms and a really good example of this is the new pension regulations with the abolition of the LTA. Lots of platforms are struggling to get this upgrade out but Seccl’s deployed it on the 8th of uh April in line with requirements.

- We pride ourselves on being fully paperless where possible. It’s difficult when we're interacting with third-parties but our approach is always to investigate how can we make this the most efficient, most automated and most seamless process for clients and advisers.

(43:00) SEI Presentation

Sophie Anne Cowper, Solutions Consultant from SEI addresses three common challenges that wealth managers face and demonstrates how the SEI wealth platform can address these at scale.

We started building the SEI wealth platform about 15 years ago now and importantly we reinvest about 10% in R&D each year so you can imagine the level of capabilities that we've built over the years but we are still adding significantly to that every year and these include books and records, asset transfers, client reporting and investment management capabilities to name a few.

Our model firms have their own platform which means they get the control and the ability to put their brand on everything we do. We support a wide range of firms so we have IFAs and Investment Managers all the way up to some of the biggest banks in the world and the key for us there is that we have a single code base which means that we can tailor the offering using configuration. Think of it like everyone's dining in the same restaurant but you're choosing different things off the menu. That's important to us because it means that firms all have the same options available.

(45:00) Three problems

- Rebalancing across a book of business.

- Investing cash efficiently.

- Bulk buys and sells.

“The start of the moneyinfo partnership is to get the account opening journey seamless and then take this partnership even further than account opening, data downloads and automated document delivery. We’re super excited in the direction that we're traveling in with moneyinfo.

The automation that you've got within the SEI platform is phenomenal and when we speak to adviser firms and wealth managers one of the key points of friction is the asset transfer process because client money is moving from one place to another and that's a stress for people so the more we can do to communicate that seamlessly the better.

We’re building the ability for us to push details of those transfers from SEI out to the client and adviser through secure messaging and push notifications to let them know what's happening. That's half the battle as they know that it's being dealt with. We want to give this access as part of the moneyinfo journey so advisers can request an asset transfer directly into the SEI system without leaving the moneyinfo ecosystem.”

(58:10) Q&A for SEI

Can an adviser firm managing portfolio models have full automation through the SEI platform?

You can have as much automation as you want so the rebalance functionality that I've shown you can be done on a scheduled basis so it will happen quarterly and the trades are being generated automatically with control. If you wanted to run that automation you absolutely could with flexibility and control for the firm and they can expand that level of automation as they go forward. It's about putting the client in control in terms of what works for their business.

Panel Q&A

(1:00:31)

Q1 - How do you handle AML checks and ID verification as part of the account opening process - is this done on the platform or still in the back office?

Seccl: I think it can work in different ways. We have built an integration via an AML KYC provider so the flow would be that when you key on the client it will send the details to the KYC provider to check and that would pass or fail and would then reflect in our system and once passed the client can onboard. However, if you did want to use your back offer system to do that AML check we can turn the functionality off so we have got both options for you.

Transact: A similar process for Transact although we don't have an API capability. It works in a similar way to what Annabel described. We would do the check once we received the business and we're working on delivering an upfront check within the onboarding process and bank verification at the same time so you’ll know at the point of keying the client whether it will pass or fail and can take any follow-up action to get it over the line.

SEI: We do our own AML internally but our firms tend to own that journey and I think our approach is very much best to breed so what we see is that firms use that as part of their onboarding journey for example as a moneyinfo step and that's how we would look to see that working. We want to give the option for firms to choose AML from a provider of their choice and then make sure that can be integrated into the flow.

moneyinfo: We see firms delivering their ID documentation through the portal and we're in analysis to integrate ID and AML tools as part of the workflow process we saw earlier. We can streamline the process through the portal for the adviser firm and we've got the opportunity to ID the client directly on the app so that's a piece of work that's coming on our roadmap that we're analysing right now. Watch this space folks!

(1:03:27)

Q2: For transact - Did you say that documents can be automatically delivered into moneyinfo?

Transact: There's a bit of excitement about that and not just yet but hopefully in the next couple of months. We are working hard working with Tess and the team at moneyinfo to make that happen soon.

moneyinfo: moneyinfo is going to automatically collect documentation in bulk from the Transact platform. This is the stuff that you can get from the documents pickup page or the client can get from the pickup page and it is going to come automatically from Transact into moneyinfo. We'll pick it up and deliver it to the correct client and the folder that you want it to be delivered into. Whether it's a statement or a contract note that will happen automatically. Your client will receive a push notification on your branded moneyinfo app so that they can go directly from that notification to view the document. The firm will get details of that documentation and when it was delivered and read so a really powerful integration that should be out in the next couple of months and we're really excited to be delivering that with Transact.

We have this facility with a number of platforms so please contact us for more information if you are interested in knowing more about our automated reporting service .

(1:04:50)

Q3: For Seccl - How do I get my client data from out the back office to automatically prefill Seccl client details so I'm not duplicating data entry?

Seccl: I don't know what back office you are using but it's a good question and anything that you can see in our user interface is available via our API. That means you can very easily create a client by sending us the data points and the moneyinfo integration is a good example of this. They are pre-populating that in the moneyinfo portal for the adviser to review so it will remove that double keying but in terms of integrations it's on the back office if they can provide the data via the API and send it to us.

moneyinfo: It's very easy and quick to do this through the portal as we're at the centre of the ecosystem and we integrate with the back offices. If you're using Xplan, Curo, Intelliflo office or Wealthcraft we pull data into moneyinfo from those back offices and can pass those client details straight into the platform as part of the digital onboarding with the client. We're connecting up the portal, platform and back-office to deliver the best possible process for the adviser and the client.

(1:06:46)

Q4: Will performance data be available as well as transactions as this can help us to mitigate costly reporting requirements?

SEI: Absolutely performance is super important, and we have a performance capability and the whole idea of the straight-through-process is putting this where the adviser wants. We will be passing that to moneyinfo to expose in both the client portal and through statements that get delivered through automated reporting.

Seccl: All our transaction data is available via our API so you can build your own performance tool by mining the data.

moneyinfo: We're not taking any performance numbers from Transact today is that something that you would be considering in the future?

Transact: We're open to taking a steer on and what the next thing is that we work on so it could well be that and we've got the tools on our website. The document sharing (automated reporting function) that we’re working on will be able to deliver performance documents to the client via that mechanism. That's how a lot of firms are doing it, through reporting rather than data as it can be tricky data to get right.

moneyinfo: We take performance data from a number of parties now and we're always keen to increase that so we're listening to what our mutual clients are saying and we're planning our roadmap based on that feedback. Transact, Seccl, SEI and ourselves are always keen to hear what you'd like us to focus on so please let us know your priorities.

(1:08:00)

Q5: Are you working towards clients giving consent to a recommended change to investments via moneyinfo going straight through to the platform removing the adviser input?

For example, a change to the investment strategy or a withdrawal.

moneyinfo: All of the integrations we’ve discussed today are just the first step in a journey that we're on with these platforms. We've got real appetite from our three guests to do as much as we possibly can to change the way that advice firms do business for the better. We've already got firms running rebalancing processes through moneyinfo, delivering those rebalance reports through to the client for consent. Take the process on and the next step is for us to connect into APIs that allow us to push those rebalance confirmations through the platform. The platforms have got APIs that can support that for us so we'll be looking to do as many processes as we can to streamline working and cut out rekeying.

SEI: I think that's probably definitely next on our agenda once we finish the initial work in the six months coming. We already have APIs and we want to expose them and connect up and make that journey available.

Seccl: It's really exciting what it is possible to achieve in terms of automating the adviser journey. What we're doing with moneyinfo is allowing suitability and platform terms acceptance to happen in one go and the next step on to that is to automatically create the accounts and automatically create the transfers. It's data points that you've already gathered in moneyinfo and it doesn't make sense that someone has to then go on and rekey that instruction. It feels like this is just the start of what’s possible. It will make us all more efficient, reduce cost, save time and it's a win-win for everybody.

(1:11:04)

Q6: Will generic platform documents provided at application stage such as terms and conditions need to be uploaded to each individual moneyinfo client or could they be held together in a generic folder for sharing, I’m currently using transact?

moneyinfo: We are doing exactly that and having those generic documents ready and available to be sent. We have the generic terms and conditions and all the other stuff that client needs to see at the point they consent to opening the portfolio on the platform. That would be the privacy notice, cost and charges report etc. We've got a resource Library within moneyinfo that can store generic documentation and moneyinfo's workflow can automatically pick that up and transition it out to the client or to an adviser. It happens automatically without you having to do it on a client-by-client basis. You can run workflows in bulk and you can run them individually, but the important thing is that you can tell a workflow what it needs to collect and send out as part of the process. It’s really exciting and a huge point of friction removed for firms.

(1:12:27)

Q7: One of the biggest pain points when moving assets to a new platform is to work out the status. We spend a lot of time with our back-office staff chasing the platform for updates. Are there any plans to update adviser and clients on what's happening during this process?

moneyinfo: This was something Sophie covered earlier in the work that we're doing with SEI. What's exciting is how we'll transition that through the activity timeline recording the notifications and messaging for clients. I think we're hearing loud and clear that it's going to be popular.

(1:13:00)

Q8: Where do you see the developments and biggest benefits happening over the next 3 or 5 years?

Seccl: We describe ourselves as the embedded investment platform and I think what we've seen is that an adviser has multiple different tools to service their clients. I think where we see the market going is there'll be the emergence of cash flow modelling as a platform, CRM as a platform and it's creating this one-stop shop for the advisor to service all their clients’ needs.

Transact: I echo the one-stop shop idea. I think it'll be very quick in the next year or so that we'll catch up in other platforms with stuff like account opening and things like that will be run of the mill. I think incorporating pretty much the whole advice process into one sort of system or console but as part of an integrated ecosystem because none of us technology providers can do everything brilliantly.

moneyinfo: We are good at what we do but when you try to build a big behemoth system that does everything, you can't do everything well. Firms want to have flexibility and control. Part of that ecosystem will be where adviser and client communicate. That will be one place but there will also be back-office tasks and portfolio management tasks. As long as we keep driving the ecosystem and building connectivity we're going to give the best possible solution for our mutual firms. And it isn't one solution for every firm as every firm has different propositions, different clients and different target markets. We need to ensure that the technology can support that through strong deep integration which is exactly why we're all here today. It's part of an overall ecosystem that is modular. You've got all these options and people pick and choose what they want and what works for them.

SEI: You're only really as good as your data. It's super important for firms to be able to extract that data and use it for AI. That starts with good access to data. It's the foundation of your business and until you get your data right you can't benefit from all the fantastic tools that are coming out on the market particularly around AI which is going to be a real game changer.

moneyinfo: Quicker than three to five years, 2023 is the year of generative AI and now suddenly we're all looking at how we can practically implement AI use cases and make sure they're trustworthy and have the governance around them. We're going to see exciting stuff happening this year integrating AI tools like Microsoft co-pilot and we're seeing some great industry AI tools such as multiply and satin AI etc. There's all sorts going on which is really exciting and our job is to bring those into moneyinfo and show how AI can really drive efficiency, giving adviser and client more time to spend on the conversation whilst automating key processes and taking out the heavy lifting.

AI is critical and Sophie is spot on. If your data is not right then you've not got the right foundation in place. That's why integration is fundamental. With all our platforms partners, the daily feeds of plans, valuations and transactions and now documentation are absolutely at the core of aggregating data for firms. We can't underestimate how valuable those are and Transact you've had those for 15, 20 years or more. The feeds are absolutely at the heart of it and we've got the ability through moneyinfo to make sure you've got that clean and accurate data set. We are getting it direct from the platforms and presenting it to the client the momentum is there to keep that data clean.

We have a support process with all of you. We talk together so that if our mutual clients have an issue with their data feed, sometimes they do go wrong - files aren't there or credentials change or some data is not quite right. We've got a process, managing that through our support team so that our mutual clients don't have to get involved and that's really important because it's a technology problem, it's not an adviser problem. That's working really well between all four parties that we've got on today's webinar.

(1:19:00)

We're coming towards the end of our time and I'm sure there are lots of our audience that are keen to find out more about how you could help their business or how moneyinfo could help their business. Here are the contact details for the panel.

To contact SEI please click here .

To contact Seccl please click here .

To contact Transact please click here .

To contact moneyinfo please click here .

Or just give us a buzz on 03303 600 300 and we'd be more than happy to chat with you about all of this brilliant stuff and more that you've seen today.

A big thank you to Sophie, Annabelle, Tom and to Richard for presenting so brilliantly.

That brings us to the end of our webinar - Advisor Tech live 10. We’d love to hear your feedback.

[1] API = Application Programming Interface – A method for two different systems to talk to each other by exposing functionality within the system that programmers can use in other systems without knowledge of how the underlying system works.