Money in Excel: Be ready for the new revolution

Justin Cash, writing for Money Marketing has highlighted the launch by Microsoft of new money management tools in Excel calling it a brave new world for a technology company.

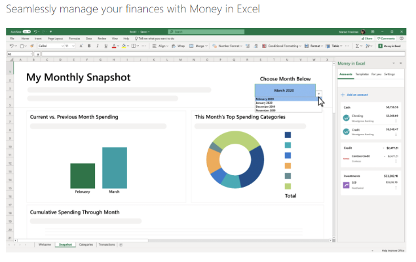

Money In Excel, will allow users to connect their bank accounts, credit cards and store cards to manage their finances via Excel.

Prospective clients can aggregate their financial data and make this data available to share with a financial planner.

Potentially, this could reduce the cost of providing advice since the hard work of pulling together the clients existing finances (their assets, liabilities, income and expenditure) will all be in one place ready to be analysed.

Not so unbiased.co.uk

Microsoft will be in a position to sell leads to financial advisers, along similar lines to unbiased.co.uk but with the advantage that on purchasing the lead the adviser firm could already know the size of the prize.

Microsoft teamed up with an app called Plaid for this project, which itself was bought by Visa for $5.3bn in January.

Shape our reality and boldly go where no fintech has been before …

According to Eric Sager, COO at Plaid - it might surprise people to learn that Plaid are talking to more than 25% of Fortune 100 companies about serious fintech initiatives. Many of these larger, tech-forward companies have little to no role in financial services today but will likely help shape our fintech reality for decades to come given their consumer footprint.

Financial advisers using moneyinfo are already at a considerable advantage over those waiting for Microsoft to enter the UK.

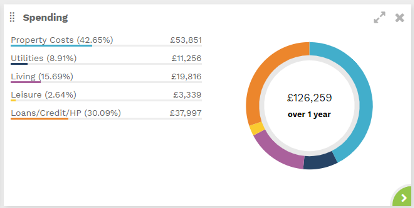

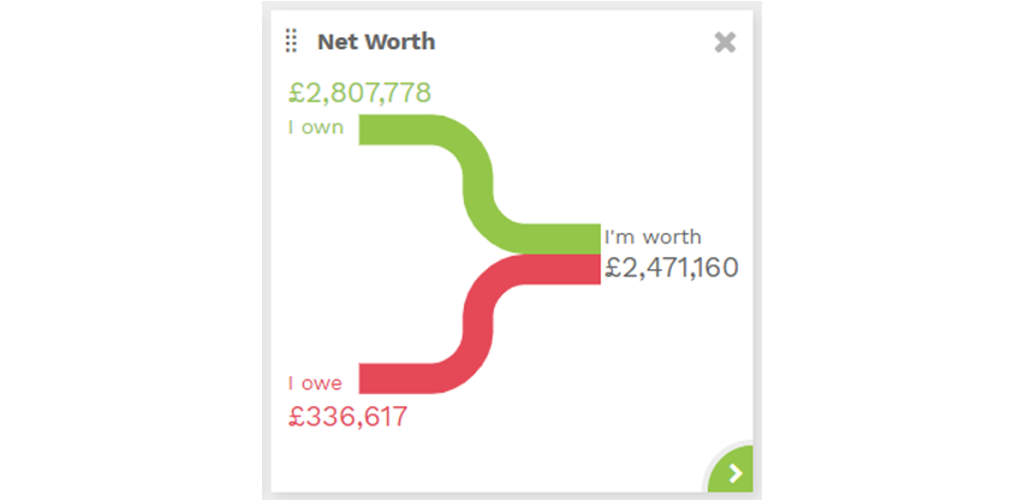

Firstly, any client can already aggregate all this data and much more using moneyinfo - we aggregate assets, liabilities, income and expenditure from bank accounts, credit cards, store cards, providers, platforms, D2C investment platforms and even land registry for property details.

We aggregate data via Yodlee who have wider coverage than Plaid in the UK. We are registered as an AISP with the FCA and can aggregate data via banks Open-APIs under the much heralded PSD2 open-banking initiative.

Unfortunately, banking aggregation coverage in the UK is still weak by comparison to the US and the banks continue to put hurdles in the way to make using the aggregation hard work for clients. This will improve over time and some clients will be prepared to aggregate their data together.

This will be further improved, if as an industry we can get our act together and enable the move from open banking to open finance.

If clients are prepared to aggregate their data, which they will only be prepared to do if the experience is easy and reliable,

then before long clients will be able to press a button and run a needs analysis across their financial situation.

This will provide recommendations for how much they should save towards their retirement, keep in an emergency fund, how much they can spend in retirement and track that their spending is on target.

Their life assurance and income protection needs will be calculated based on protecting the cashflow against death, disability and other disasters.

None of this is particularly hard for computers to analyse, it is already available in all the leading cashflow tools such as I4C, CashCalc, Prestwood etc.

The planning tools will suggest suitable risk strategies based on the client's attitudes to risk and the client will be able to execute these via investment platforms that will be tuned into Money in Excel.

This will work for clients unless they have complex financial lives.

The clients of financial advisers will continue to be those with complex financial lives who don't fit into the easy models for financial advice.

Having sold their business, inherited significant wealth or received large compensation payments, they need help to understand what to do and reassurance to hold their nerve when the markets move against them.

In the future, clients might arrive at their financial adviser with all their data ready to be analysed, and we'll enable our firms to import this data into moneyinfo and make it available to use in their other systems.

These clients will be easier to advise, and advice could be more competitively priced because of the reduction in time spent aggregating their data. This could help to reduce the advice-gap where clients need advice but can't afford It.

In the meantime, financial advisers are at a distinct advantage.

Advisers can aggregate their clients their investments, savings and pensions using contract enquiry and platform data downloads alongside all of the personal finance data which puts them at a huge competitive advantage over Money in Excel in being able to analyse all of a client's wealth.

We will continue to push the boundaries of what can be aggregated ensuring our clients are the most efficient in the industry and enabling them to take full advantage of the new FinTech revolution.