Navigating Volatility

The new Fairstone client survey “Navigating Volatility” highlights the importance of the Chartered professional qualification as being essential in clients’ decision making around who they will appoint as their adviser.

“Brain surgeons perform brain surgery; financial advisers advise on finances – I am neither and would prefer to go to an expert on both accounts.”

Fairstone have surveyed a thousand of their clients to understand how they are feeling about their planner given this year’s unprecedented events.

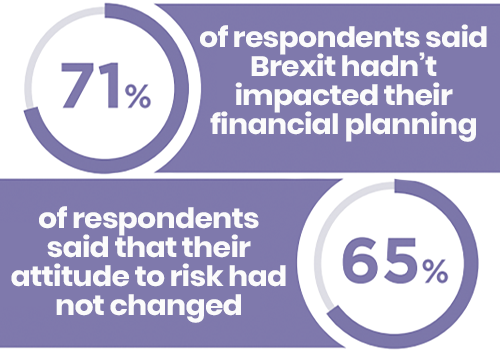

It’s good to know that two-thirds of their clients do not feel that Brexit or Covid has had any impact on their attitude to risk which they say hasn’t changed over the course of their lifetimes.

It’s good to know that two-thirds of their clients do not feel that Brexit or Covid has had any impact on their attitude to risk which they say hasn’t changed over the course of their lifetimes.

The report highlights the great opportunity for advisers with the wealth transfer that will be happening over the next three decades as wealth is transferred from baby boomers to the millennials.

It also reports that nearly 2/3rds had not introduced their adviser to their families despite 90% wanting them to provide more support to the next generation.

“It had not occurred to me to do this. Now you’ve posed the question, I will do so.”

A client comment in the survey highlights that advisers need to discuss generational planning with their clients and look at how they engage with this younger, more digitally aware client base.

According to the survey, 69% of clients prefer to receive their financial information digitally and this trend is likely to continue as adviser’s client are extended by younger clients who are more digitally aware.

According to the survey, 69% of clients prefer to receive their financial information digitally and this trend is likely to continue as adviser’s client are extended by younger clients who are more digitally aware.

The Fairstone survey advises that, “Technology can improve efficiency and facilitate game changing innovation and ensure that as a business, you are ready with models and architecture in place to quickly adapt when the next change comes.

While face-to-face and direct contact with clients will always remain at the core of our business, technology can allow businesses to be agile and adapt quickly to change while enabling advisers to spend more time with clients as well as work more efficiently.”

You can download a copy of the survey here.

Sim Sangha is business development director at moneyinfo. For more information please call 03303 600 300 or to arrange a personal 1:2:1 consultation click here.

03303 600 300