What should firms be prioritising in 2025? Owen James Wealthtech Matters: The Business

Tessa Lee, our Managing Director, recently joined 50+ senior leaders from the wealth management community at the Spring WealthTech Matters: The Business, hosted by Owen James. It was a packed agenda, full of conversation around where the industry is heading, with a guest presentation from Tessa which you can watch in full above.

The event coincided with Owen James’ latest Scene Setter Findings, research designed to provide an in-depth insight into what the wealth management community is collectively thinking, including their biggest concerns, priorities for strategic development, barriers to productivity, and intentions regarding future tech-spend.

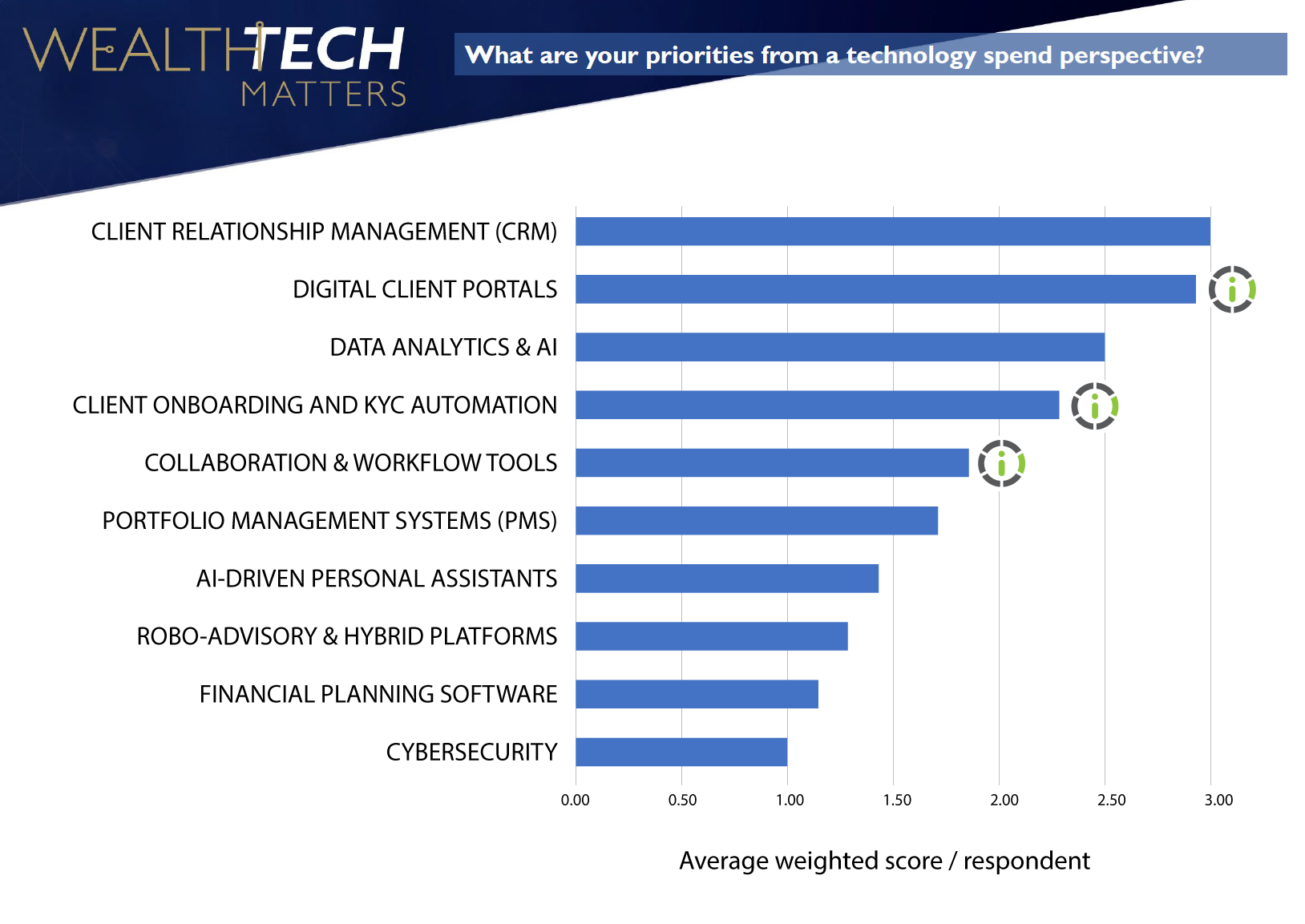

And the good news? moneyinfo is uniquely positioned to support firms across three of the top five tech priorities for UK Wealth COO's from the 2025 research:

Digital Client Portals (ranked 2nd

overall)

Digital Client Portals (ranked 2nd

overall)

Just over a decade ago, the idea of a digital client portal was virtually unknown in wealth management. A few pioneering firms saw the potential early on and embraced technology that would soon redefine client communication. Today, advisers are recognising that their clients expect far more – not in the future, but right now. Whether on the move or at home, clients want instant updates at their fingertips. Logging into clunky portals on a desktop no longer cuts it. They’re looking for a seamless experience – one that mirrors the ease and responsiveness of the apps they already use every day.

Despite heavy investment across the sector, many firms remain constrained by outdated systems. Multiple logins, poor interfaces, and fragmented tools continue to frustrate clients and advisers alike. The demand for a unified, intuitive digital experience has never been greater – and for those ready to deliver it, the opportunity is enormous.

moneyinfo transforms this challenge into a competitive advantage. Our fully brandable client portal empowers firms to streamline communication, offer a modern app-based experience, and consolidate all client interactions into one secure environment. It’s not just a portal – it’s a smarter, simpler, client-first way of working that enhances loyalty, boosts engagement, and gives advisers more time to focus on what really matters.

Client Onboarding and KYC Automation (ranked 4th overall)

The onboarding process is often the first impression a client gets of your firm – and for many, it's still a paper-heavy, time-consuming ordeal. With average onboarding times sitting around 22 days, clients are left waiting while advisers wrestle with manual forms, duplicate data entry, and systems that don’t speak to each other. It’s a frustrating start to a relationship that should be about trust, transparency, and value.

Fortunately, the tide is turning. With nearly 9 in 10 firms increasing their tech budgets in the last 18 months, leaders are recognising the role technology plays not just in compliance, but in creating a smoother, faster client journey. The firms standing still risk being left behind.

moneyinfo gives firms the tools to radically reduce onboarding times and remove friction from the start. From secure data collection and eSignatures to KYC workflows, our platform simplifies the entire onboarding journey. The result? A process that’s faster, more accurate, and actually enjoyable for clients – without compromising on compliance.

Collaboration and Workflow Tools (ranked 5th overall)

Not so long ago, advisory firms relied on a messy mix of spreadsheets, emails, and phone calls to keep things moving. It was slow, error-prone, and completely unsustainable. In today’s environment, advisers need to move faster – not just to keep clients happy, but to meet ever-tightening regulatory demands and deliver advice efficiently.

Modern firms are turning to connected digital workflows – ones that handle everything from bulk messaging to real-time collaboration across teams. The focus is shifting from isolated tools to integrated systems that support the entire advice process. When tech, people, and processes are in sync, advisers can spend less time chasing admin and more time adding value.

moneyinfo brings everything – and everyone – together. Our platform centralises your workflows and enables seamless collaboration across teams, while keeping compliance at the core. Tasks are automated, data is connected, and your clients stay in the loop without the back-and-forth. It’s the smarter way to run your firm – one that empowers your people and scales with your ambition.

Real results – Clifton Asset Management

Clifton Asset Management are a great example of what this can look like in practice. With their branded app, My Viewpoint, powered by moneyinfo, they’ve saved thousands of hours of admin time while supporting sustained growth across multiple acquisitions.

Here’s what they’ve achieved:

- Over 2,000 admin hours saved annually

- 5,000+ documents delivered automatically each year

- Seamless integration across seven acquisitions since 2019

For Clifton, it’s not just about efficiency – it’s about scale, growth, and delivering a better experience for every client.

View the Clifton case study video here.

Unlock your peak performance

Firms that are getting this right aren’t just improving efficiency, they’re transforming the way they work. With a fully branded app and portal, they’re offering clients a joined-up experience with real-time access, secure messaging, and smooth onboarding.

Tessa’s talk made it clear: integration is no longer a nice-to-have. It’s a strategic advantage. And the Scene Setter research confirmed it. Digital portals, onboarding automation, and workflow tools are where firms are investing next.

From digitised fact finds to automated workflows, moneyinfo brings everything together into one seamless ecosystem, built for advisers, not just clients. The result? Less admin. More control. And an experience that reflects the high standards your firm sets.

This year, Owen James unveiled The Pulse – a dynamic new digital portal offering curated insights into the most influential trends shaping the distribution landscape.

If you are an FCA-registered adviser or wealth management firm and would like access to the full Owen James Spring Scene Setter report featured in this article, simply complete their short questionnaire. Upon completion, you’ll receive exclusive access to The Pulse and its full suite of insights.

Click here to take part in the survey and unlock access.