Can the hybrid adviser service twice as many clients?

The average number of clients per adviser is 112 but embracing technology, that number could reach as many as 200 clients per adviser.

Speaking at the Financial Technology Research Council’s (FTRC) - Empowering Advice Through Technology conference, Stephen Mitchell, head of proposition at FE fundinfo believes technology has the power to nearly double the number of clients an adviser can service.

To achieve this, he says that client portals and understanding the digital journey will be key.

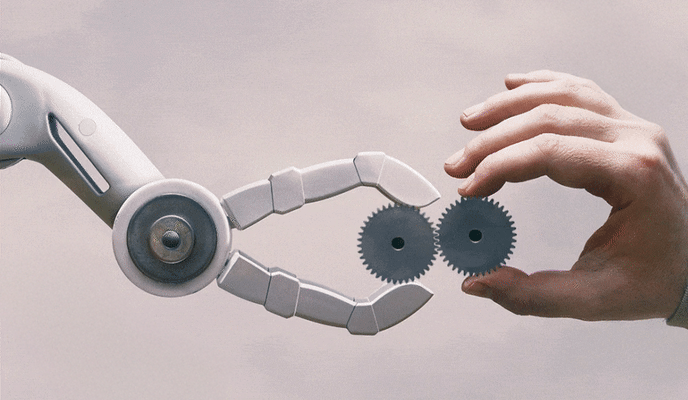

Tech could double clients served per adviser.

Two years ago, many advisers would have been sceptical and nervous about using digital technology with clients but lockdown has shown us all a new way of working and how virtual meetings can be more efficient for many of the meetings we would previously and automatically have done face-to-face. Virtual meetings are generally shorter, the agenda is covered much more quickly and there’s no travel time.

Virtual meetings shouldn’t replace all your meetings, but the hybrid adviser supported by technology can achieve productivity gains that would have been impossible to imagine, pre-lockdown.

Onboarding new clients

The hybrid adviser will still want to meet new clients to establish a personal relationship. This probably involves a minimum of two face-to-face meetings, the discovery meeting and the recommendations meeting but for everything else, your app is going to make the onboarding process a better experience for both you and your client.

With a secure method of sharing and signing paperwork onboarding is so much easier. Appointment booking, workflow, and fact finding can all be handled efficiently through the app and processes that took weeks can be completed in a few hours.

The client can see their fact find and net wealth building as letters of authority get processed and the information comes into your back-office and flows through automatically to your app. Clients get a full audit trail of all correspondence, so there is never any doubt about what’s been said and they can view and accept recommendations at a click on their phone, tablet or PC, with biometric security to authenticate the recommendations.

But if you thought onboarding could be slick using an app, it really comes into its own when you’re servicing existing clients, which for most advisers is probably 80% of their time.

Servicing existing clients

In the digital world of the hybrid adviser, the client review is much slicker than the old paper process. Press a button and the client review workflow is started for all clients needing a review in the coming month. The client is sent a request to double-check their fact find for any changes to their circumstances and asked to book a convenient appointment in the adviser’s diary for their review.

The fact find has been automatically updated with current values and income and expenditure from the client’s bank accounts. It’s a snapshot of the data that’s been shared with the client through your app and the whole process of updating it, takes minutes for the client. Once confirmed by the client, the administrator can double check the changes and confirm and lock the fact find, so that it forms part of the compliance audit trail.

Any recommendations can be shared with the client before the review meeting, to ensure that the review is there to answer any questions that the client may have. If the recommendations are complex or the current situation has changed significantly, then the review process can be extended.

As before, any recommendations can be authorised by the client through the app, providing an audit trail for both you and the client.

The process is slick, efficient and uses technology to complement your relationship, never getting in between you and your client.

The hybrid adviser is a better adviser

With more time to advise your clients, doubling your client base, whilst improving your work-life balance is eminently achievable.