Unlock 90% Faster Onboarding with Painless Platform Switching

Switching investment platforms is often seen as a necessary evil in wealth management - and for good reason. It’s a complex, time-consuming process that can disrupt your firm and test your clients’ patience.

According to a 2025 industry whitepaper, 89% of financial advisers have a negative gut reaction to the idea of transferring their clients to a new platform. It’s not just a feeling; it’s backed by hard numbers. Cumbersome platform switching processes cost UK advice firms an estimated £517 million every year. This staggering cost comes from time lost to rekeying data, correcting errors, and manually chasing transfers - resources that could have been spent serving existing clients or onboarding new ones. In fact, 89% of advisers report that time wasted on poor platform service could have been used to win new clients.

Beyond the hit to productivity and revenue, clunky switching damages client relationships. Delays and errors force advisers into uncomfortable conversations - over half of advisers had to apologise to multiple clients in the past year due to service delays during transfers. It’s clear that the traditional way of switching platforms, with its paper forms and patchwork of systems, isn’t just inefficient; it’s unsustainable for a modern advisory business.

Why Integration and Automation Matter

What’s driving this inefficiency? A major culprit is the lack of integration between the myriad systems advisers use. An average firm might use 5–7 different systems to manage client portfolios - and upwards of 11–13 systems when various platform provider tools are counted. These systems often don’t talk to each other. It’s no wonder 85% of advice firms say that insufficient integrations are a major cause of inefficiencs in their operations. Critical client data ends up being entered and re-entered across different platforms. In a typical new business or account transfer, the same client information gets keyed in at least three times on different forms and systems. Every one of those manual touchpoints is an opportunity for delays or mistakes.

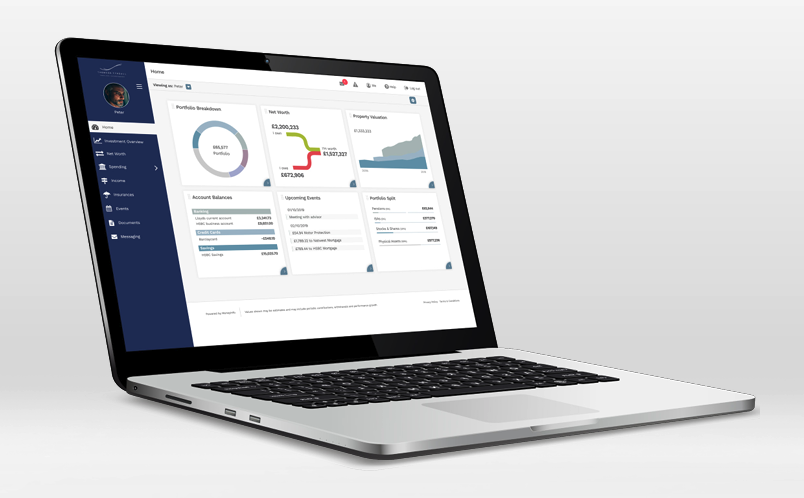

Integration and automation directly tackle these pain points. By connecting systems and automating workflows, you can replace slow, error-prone steps with seamless digital processes. Imagine initiating an account transfer or opening a new account for a client in one unified platform , without jumping between your CRM, the platform’s portal, and PDF forms. That’s the vision behind Moneyinfo’s approach - and it’s already reality for forward-thinking firms. Advisers are increasingly drawn to platforms that offer seamless integration and automation to streamline operations and cut out manual tasks. Why? Because integration and automation together “ensure an efficient, accurate, and automated process” for platform switching , drastically reducing the friction we’ve come to accept as normal.

Efficiency Up, Errors Down: Real Results from Automation

When you integrate your systems and automate elements of your account opening processes, the efficiency gains can be game-changing. For example, Moneyinfo client Thomson Tyndall, a UK wealth management firm, recently transformed its platform account opening process using Moneyinfo’s integration with Transact. The results are obvious: Thomson Tyndall achieved a 90% reduction in processing time for client onboarding and transfers - tasks that previously took days or weeks can now take just minutes. How did this happen? By eliminating redundant data entry and moving to a fully digital workflow, errors have been virtually eliminated and approval times sped up .

This kind of time savings isn’t an anomaly. Industry experts note that consolidating data onto a single integrated system can make tasks like client valuations up to 10× faster, all while reducing duplicate entries and errors file. In Thomson Tyndall’s case, instead of filling out forms and chasing signatures, advisers can trigger the whole account transfer process from within one system. Clients give consent through a secure mobile app with a biometric login, and all the information flows directly to the platform. No paper, no delays, no missed fields. As a result, clients enjoy a smooth, frictionless experience from the start - no more waiting in limbo or dealing with piles of paperwork. One adviser described the change as giving their clients “a far better experience while freeing up our team to focus on what truly matters - helping them achieve their financial goals.”

Crucially, automation doesn’t just make things faster; it ensures things are done right. With integrated systems, there’s a single source of truth for client data, so the chances of errors due to outdated information or manual input vanish. Fewer errors mean fewer transfer rejections and follow-ups, which in turn means even more time saved. It’s a positive feedback loop: efficiency breeds more efficiency. And all that time that was spent on admin can now be invested in value-adding activities.

Better Engagement and Happier Clients

Streamlining platform switching isn’t only about operational efficiency - it’s about delivering better service to your clients. In an age where clients expect Amazon-like convenience even from their financial advisers, a clunky onboarding or transfer experience can dampen their confidence. Conversely, a fast, transparent process can seriously boost client satisfaction and engagement. When advisers leverage automation to handle the heavy lifting, clients notice the difference. They’re kept in the loop with real-time updates instead of having to call for status checks. They can securely e-sign documents or provide consent through a few taps on their phone, rather than enduring week-long back-and-forths.

The outcome is clients who feel more in control and informed during a platform change. They aren’t left wondering what’s happening with their money. That peace of mind translates into trust the bedrock of any strong adviser-client relationship. Moreover, when your team isn’t bogged down chasing data or correcting errors, they can spend more time proactively communicating with clients , advising on strategy, or addressing concerns. In other words, integration and automation free your people to be more present for your clients. It’s no coincidence that firms with highly efficient processes also report stronger client loyalty; when you consistently deliver a smooth experience, clients have little reason to look elsewhere.

There’s also a compliance angle to client engagement. Under the FCA’s new Consumer Duty, advisers must not only act in clients’ best interests but also evidence it. Efficient, error-free platform switching is part of demonstrating good client outcomes. By embracing technology that minimises delays and mistakes, you’re showing regulators and clients alike that your firm is committed to a higher standard of service. It’s a win-win: you reduce your operational headaches while giving clients tangible proof that you value their time and their business.

Unlock Peak Performance with Moneyinfo

Platform transfers and account openings may historically “eat strategy for breakfast,” but with the right tools, you can turn them into a strategic advantage. Integration and automation are no longer nice-to-haves; they’re becoming essential for firms that want to stay ahead. As we’ve seen, automated onboarding and deep platform integrations can save you time and avoid business disruption. They cut costs, reduce risk, and most importantly, improve the experience for everyone involved

Moneyinfo is at the forefront of this shift. Our platform is built to relieve you of unnecessary admin burdens and give you the power to unlock your peak performance. We take a people-first approach to fintech, meaning our technology is designed to solve real problems advisors face every day - like opening accounts faster, keeping data in sync, and engaging clients on their terms. If you’re ready to leave behind the inefficiencies and client frustrations of platform switching, it’s time to explore what Moneyinfo can do for your firm.

This article was written based on the findings in the Woven Advice Integrate to Innovate 2025 report, sponsored by Moneyinfo. Click here to read the full report.