Why advisers must embrace tech: Featured in Professional Adviser

This article was featured in Professional Adviser, where our managing director Tessa Lee looked at the big three challenges in meeting clients’ digital expectations and explores how to overcome them.

Read the full article below.

Clients want fast, accessible, and personalised service

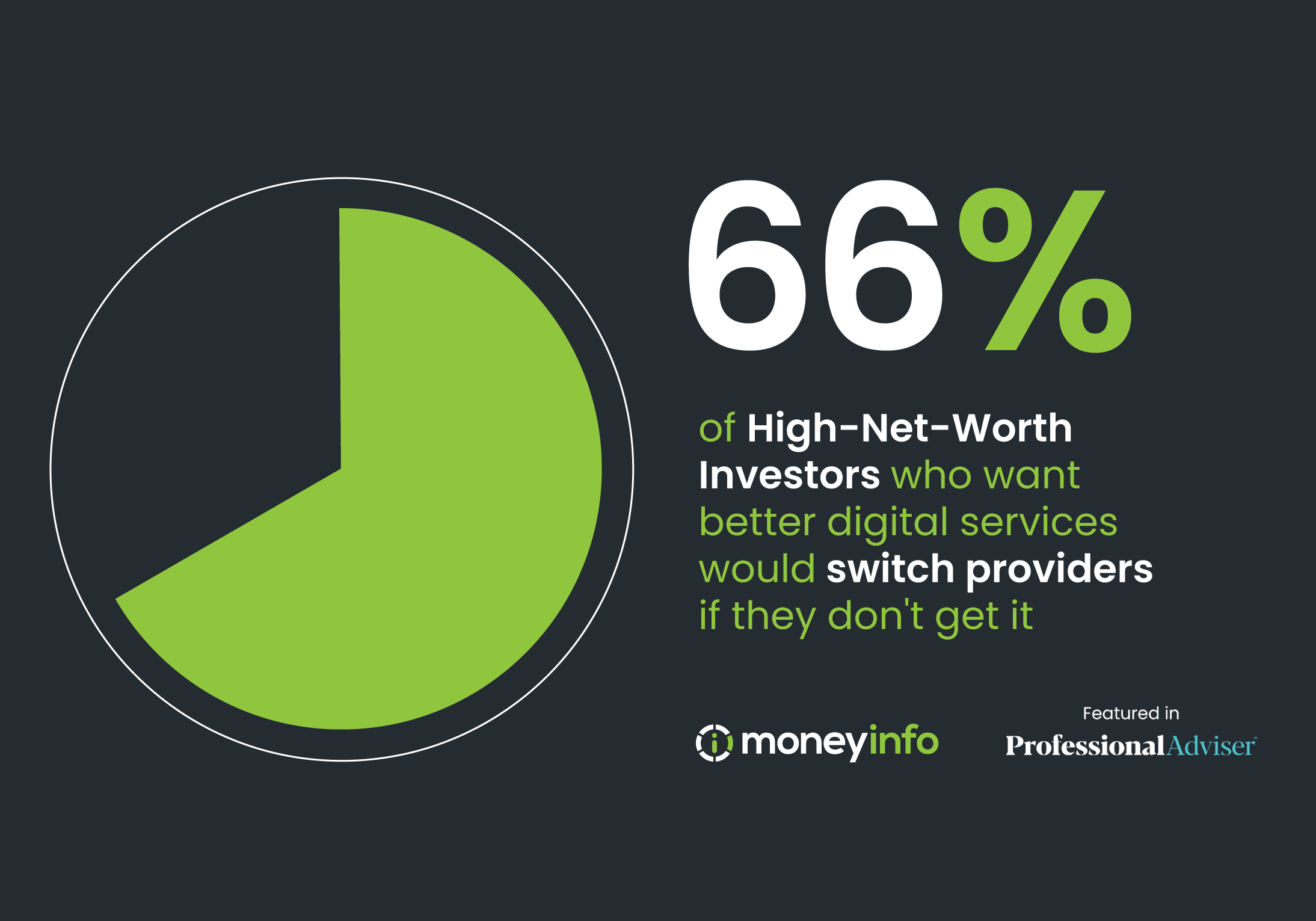

Meeting the digital demands of today's clients can feel like a big challenge for advisers and wealth managers. Clients of all ages now expect high-quality, personalised digital service that's both user-friendly and available 24/7 on any device. Research shows that more than half of high-net-worth investors want better digital services, and two-thirds of these would switch providers if they don't get it.

Yet still many advisers cling to the belief their clients won't use technology - especially older ones. That's simply outdated thinking. At Moneyinfo, our data shows that clients of all ages are using digital tools to view portfolios and communicate, with mobile logins far outpacing desktop. Smartphones and tablets have become essential to the adviser-client relationship.

So, if clients aren't the barrier to digital adoption, what or who is? What are the roadblocks - and how can firms overcome these to get the most from their investment in digital tools, driving client engagement and efficiency?

Resistance to change

Advisers themselves are the key to driving tech adoption, but many stick to traditional methods out of comfort or fear of new technology.

It's understandable - successful client relationships have been built on face-to-face and paper-based communication. Switching to digital portals and tools can feel like a big leap.

For some, the thought of navigating new tech is intimidating, especially if they don't consider themselves to be ‘tech-savvy'. This combination creates resistance to change, even when embracing digital tools could boost efficiency and enhance client relationships.

Internal adoption is critical to any tech success, but this is more than just training and support. Culture matters. When leadership embraces digital transformation, it sets the tone for the entire firm.

But advisers also need to see a clear, personal benefit - whether it's increased efficiency, better client outcomes, or business growth. The key is to make their lives easier. Firms often aim too high too fast with technology roll-out, but it's usually the small changes that have the biggest impact. For example, simple tools, like a smartphone app giving advisers instant access to client portfolios, communications and documents, can make all the difference in preparing for meetings or handling ad hoc queries smoothly.

The threat to client relationships

Advisers rightly take pride in the personal relationships and the trust they build with clients, and perhaps worry that digital tools might depersonalise this. But tech isn't here to replace human interaction - it's here to complement it. By automating admin tasks during onboarding and client reviews, digital tools free up advisers to focus on what really matters: building stronger, more personal relationships with clients through high-value work.

With 24/7 access to real-time portfolio updates, reports and plans, clients come to meetings more informed, making conversations deeper and more productive. Tech doesn't distance clients; it strengthens loyalty by making interactions more meaningful.

Lack of momentum to keep data up to date

Poor data quality can undermine digital tools, creating operational challenges that discourage both clients and advisers from fully embracing them. It's a problem that's plagued the industry for years, with little momentum to keep data continuously up to date. Traditionally, client data was only brought up to date at the annual review, when needed for review reports and other documentation.

However, the advent of client-facing digital tools has changed the game. Now there is a reason to keep client data accurate and up to date at all times. With more robust and seamless integration across technology platforms, the process is more automated and efficient than ever. Fintechs, platforms, and practice management systems are finally playing ball with each other, supporting deeper integrations that help firms adopt the best tech solutions for their operations.

And let's not forget, good data is the backbone of artificial intelligence (AI). High-quality, clean, well-structured data unlocks AI's potential to enhance the personalised advisory experience or provide insights to improve decision-making and ensure compliance.

Embrace change and lead the way

In today's digital age, clients' demands are clear – they want fast, accessible, and personalised service - at their fingertips. Overcoming barriers like resistance to change, concerns over depersonalisation, and outdated data practices is key to achieving this.

By adopting simple tools, and focusing on the tangible benefits of digital transformation, advisers can enhance both operational efficiency and client satisfaction. The future of financial advice and wealth management lies in blending technology with the personal touch – those who do this successfully will lead the way.