The Productivity Puzzle: What’s Holding Mid-Sized Advice Firms Back?

On 22nd May 2025, Owen James brought together senior leaders from across the northern advice market for A Meeting of Minds Winning Advisers North event focused on the key drivers of productivity, profitability, and industry trends facing mid-sized financial advice firms based in the north.

Their Scene Setter research sets out to uncover what’s keeping firms busy, and what’s holding them back.

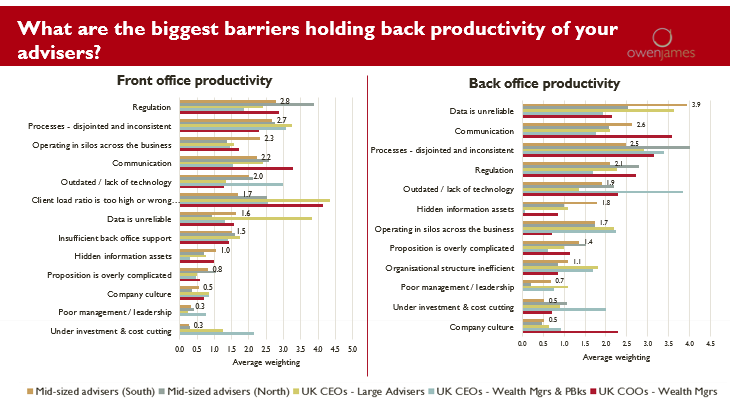

And while every firm is different, three consistent challenges stood out:

- Unreliable data

- Poor communication

- Disjointed processes

In this article, we unpack each of these challenges in more detail and explore how firms are tackling them – with a look at where moneyinfo is already helping forward-thinking advice businesses get ahead.

Unreliable data – the top barrier to back-office productivity

According to the Scene Setter research, the number one barrier to back-office productivity for mid-sized northern advice firms is unreliable data.

Disconnected systems and manual processes mean firms are stuck rekeying information across platforms. Every time data is duplicated, the risk of error increases. Not to mention the time wasted checking and correcting inconsistencies.

Advisers aren’t happy with their technology. One 2024 study found that errors now occur in 20% of client onboarding processes, with 11% of firms experiencing data input errors in half of all onboardings.*

It’s the kind of inefficiency that builds over time. It frustrates staff, introduces risk, and slows down the very processes that should be helping clients move forward.

That’s why moneyinfo is built to make data easier to manage. Our platform acts like a live signal for your data integrations. Showing you exactly how frequently each feed is updating. And we manage any issues on your behalf when something needs attention. Outsourcing the problem for our support team to fix. No chatbots, and no tickets lost in the void. We work with your core systems and leading integration partners to improve data flow across the client journey. And where issues do crop up, we handle them on your behalf, so you’re not stuck firefighting data problems. Just one version of the truth for your team and clients.

Poor communication – the second highest barrier to productivity

In many firms, communication still happens across a patchwork of emails, phone calls, spreadsheets and portals. Conversations get split, updates get missed, and simple tasks turn into slow, manual chases. It’s not just inefficient, it’s exhausting. And in an environment where timing is critical, it shouldn’t be the second most common back-office productivity strain for mid-sized advisers.

Firms must be vigilant in choosing secure communication applications that are both auditable and compliant with the FCA’s recording obligations.

moneyinfo brings communication into the heart of your client and team experience. Everything happens in one place, from secure messaging to task updates, so nothing slips through the cracks. Instead of scattered threads across different tools, your team has a single, auditable record of who said what and when. It’s quicker, more secure, and keeps everyone in the loop. Whether it’s notifying a client about a document, assigning a task to a colleague, or just making sure the right message gets delivered at the right time, moneyinfo turns communication into a strength, not a stumbling block.

Disjointed processes – slowing advisers down at every step

The Scene Setter research shows that disjointed and inconsistent processes are the third most common back-office barrier to adviser productivity. And it’s a challenge that’s all too familiar for many firms.

When systems don’t talk to each other, the cracks start to show. Advisers are forced to jump between tools, rekey the same information multiple times, and manually follow up on tasks that should move automatically. It’s slow, it’s frustrating, and it pulls focus away from what really matters. Building relationships, delivering advice, and supporting clients through life’s big decisions.

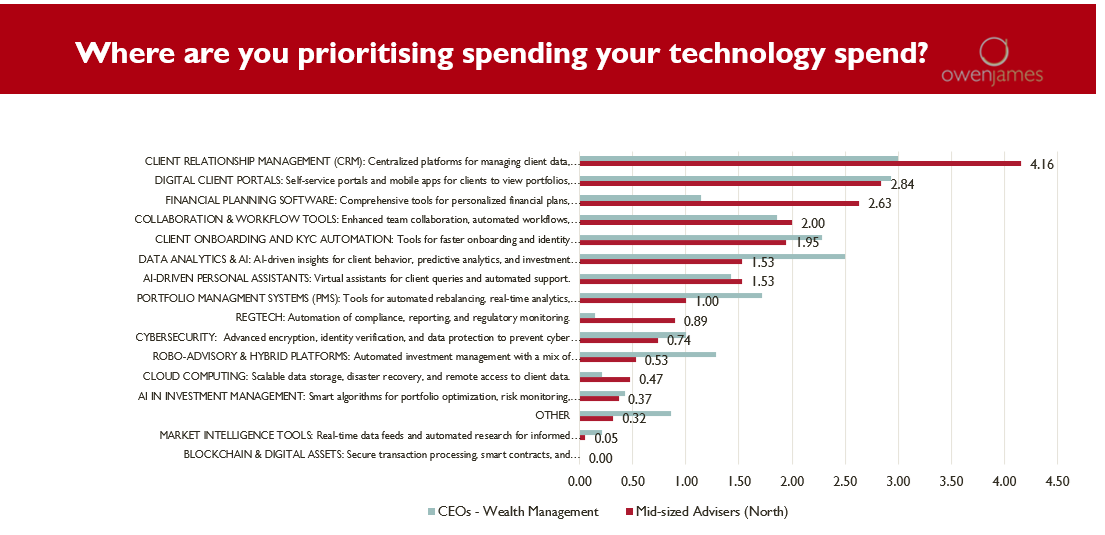

A 2024 study found that only 26% of UK financial advice firms are satisfied with their current tech stack, with many citing a lack of integration and joined-up workflows as key concerns.* And it’s no surprise. The dream of connected systems is still out of reach for too many advice firms. And the result is a front office that spends more time managing the process than delivering the outcome.

At moneyinfo, we’re focused on helping firms remove the friction. Our platform helps join up the journey. By improving connectivity between your people, processes and systems . Plugging into the tech stack where it counts, we’re helping firms reduce the friction that holds them back.

Unlocking productivity, one barrier at a time

Unreliable data, poor communication, and disjointed processes aren’t new problems. But they’re finally being recognised as the root causes of the friction so many advice firms are facing, and they’re now front and centre on the agenda.

At moneyinfo, we’re helping firms tackle these challenges head-on. Not with more tools, but with smarter, joined-up solutions that work alongside your existing systems. And by collaborating with integration partners across the industry, we’re helping more firms tackle the connectivity challenge with confidence.

Because when your systems connect, your data flows, and your team communicates with ease, everything gets better. Clients feel the difference. Compliance becomes simpler. And your advisers get the time and headspace to do what they do best.

Fix the foundation – and the rest follows. Allowing you to unlock your peak performance.

Interested in attending the next Owen James event?

Register here for Winning Advisers South on 9th October 2025.

Register here for Winning Advisers North on April 23rd 2026.

* Sources:

intelliflo.com/insights/thought-leadership/intelliflos-2024-advice-efficiency-survey

nextwealth.co.uk/financial-adviser-tech-key-trends-shaping-the-uk-financial-advice-industry-in-2024